Do you want to find a travel dialysis job but are uncertain about the tax implications? You may be surprised to learn that not only can this type of job provide great fulfillment, but there are also several attractive tax benefits.

Today, we’ll go over some of the common questions about taxes and travel dialysis jobs in this blog post, such as the IRS rules surrounding deductions related to travel expenses while on assignment. We’ll also look at other ways you may save when filing your taxes each year as a traveling dialysis nurse or tech. If you have any questions, reach out to one of our knowledgeable recruiters today!

Find a Dialysis Job: Will You Be an Employee or an Independent Contractor?

Travel nursing agencies have two different types of setup: either the nurses and technicians who work with them are employees of the agency, or they are required to be independent contractors.

As an independent contractor nurse, you would be responsible for calculating and paying taxes and self employment tax based on your taxable income. The taxes include income tax, self-employment tax, state and local taxes, and any other taxes specific to their location or work arrangement. Income tax is calculated as a percentage of the worker’s earnings, while self-employment tax includes Medicare and Social Security taxes. When working as a travel dialysis professional, these taxes can become a bit more complicated because state and local taxes vary depending on the state, municipality, or county where the individual is working.

At AHS RenalStat, you are an employee of our agency, which means we take care of these payroll details up front so that you don’t have to worry about setting money aside to pay your taxes at the end of the year. All you need to do is find a travel dialysis job that fits your qualifications, and get to work! At the same time, you can still benefit from claiming certain expenses when you file your taxes. These tax deductions and exemptions can help maximize your overall earnings.

Deductions That Can Be Claimed by Travel Dialysis Professionals

There are many deductions that you may be able to claim on your tax return as a travel dialysis professional. That’s why it’s important to track these expenses by keeping an accurate and detailed list of them, along with the original receipt for the expense. By taking advantage of these deductions, you can keep more of your hard-earned money and maximize your financial potential.

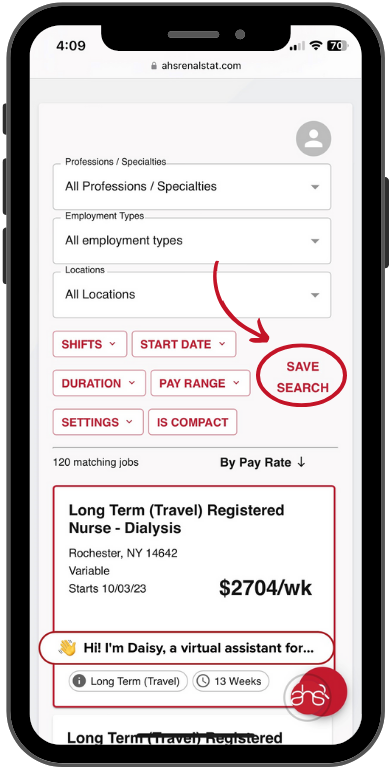

This document has some great examples of what kind of travel job would be applicable for tax deductions.

You may be eligible to claim deductions for expenses such as:

-

- Non-taxable stipends for meals and incidentals

- Airfare

- Cross-country bus fare

- Gas/fuel costs

- Vehicle maintenance

- Car rental

- Public transit costs

- Hotels

- Housing/lodging

- 401K contributions

- Professional memberships

- Continuing education costs

- Equipment or supplies used for your job

How to File Taxes as a Travel Dialysis Nurse or Tech

As a travel dialysis worker, it’s important to know how to properly file your taxes. One of the first steps is to find a dialysis job that suits your needs. Once you have a job, you’ll need to keep track of all your earnings and expenses related to your work. It’s recommended to use a tax professional who is knowledgeable about self-employment and travel deductions. They can help you navigate the tax laws and ensure you are maximizing your deductions while avoiding any potential issues with the IRS. By following these steps and seeking professional help when needed, you can successfully file your taxes and avoid any unnecessary stress.

Planning and Saving Strategies for Travel Dialysis Workers

Planning to find a dialysis job is just the beginning of your journey. Once you’re on your way, it’s important to have a solid plan and saving strategy in place to make the most of your adventures. Luckily, with some expert guidance and a little bit of smart planning, you can make travel dialysis work for you.

Some tips to keep in mind include setting a realistic budget, doing research on your destination to find deals on accommodations and activities, and exploring resources like online travel communities and discount websites to save money. By following these simple planning and saving strategies, you’ll be well on your way to enjoying a fulfilling and exciting career in travel dialysis.

Find a Dialysis Job—Get the Support You Need

AHS RenalStat believes in making the process of finding a travel dialysis job as seamless as possible, from support during the search to assistance during tax season. With our experienced team, you can rest assured that we will be handling your payroll so you can enjoy your travel dialysis job to its fullest. If you are interested in pursuing a career as a travel dialysis professional, feel free to call one of our recruiters today – we can discuss any questions or concerns you may have!